site.btaBanking Services in Bulgaria among Most Affordable in EU

Banks in Bulgaria offer the lowest interest rates on newly issued housing loans for households in national currency (BGN) among comparable countries in the Central and Eastern European region, according to an analysis by the Economic Analyses and Policy department of the Association of Banks in Bulgaria (ABB). In general, banking services in Bulgaria are among the most affordable in the European Union (EU), the study concludes. It examines current trends in the development of banking services in Bulgaria and the EU and focuses on countries in Central and Eastern Europe that are comparable to Bulgaria in terms of territory, population, and level of economic development.

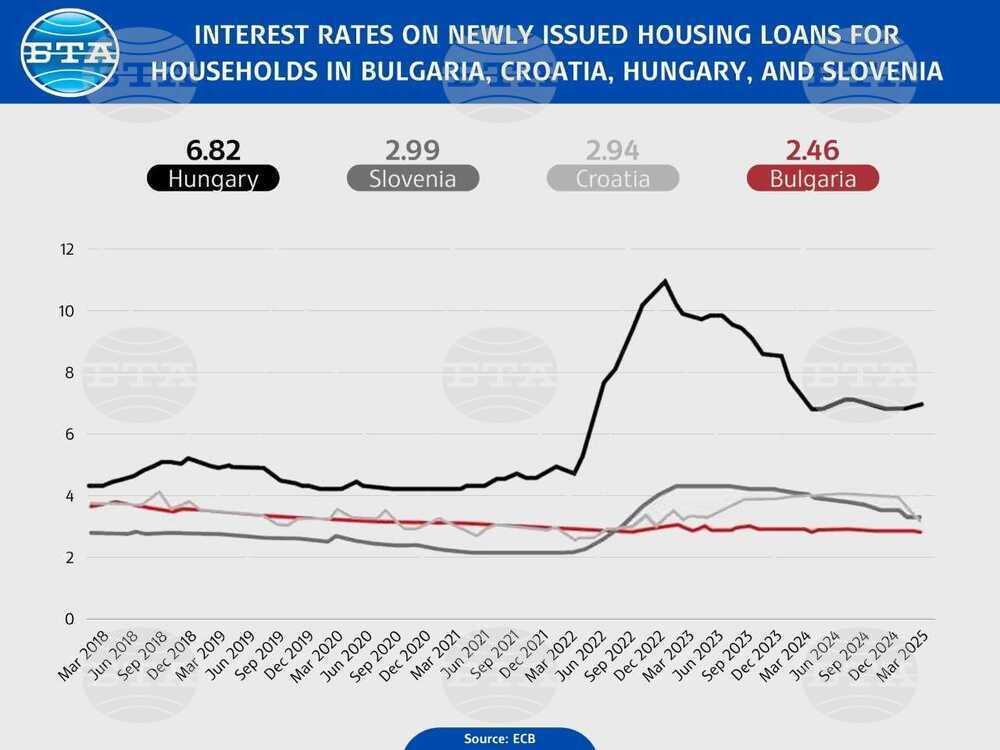

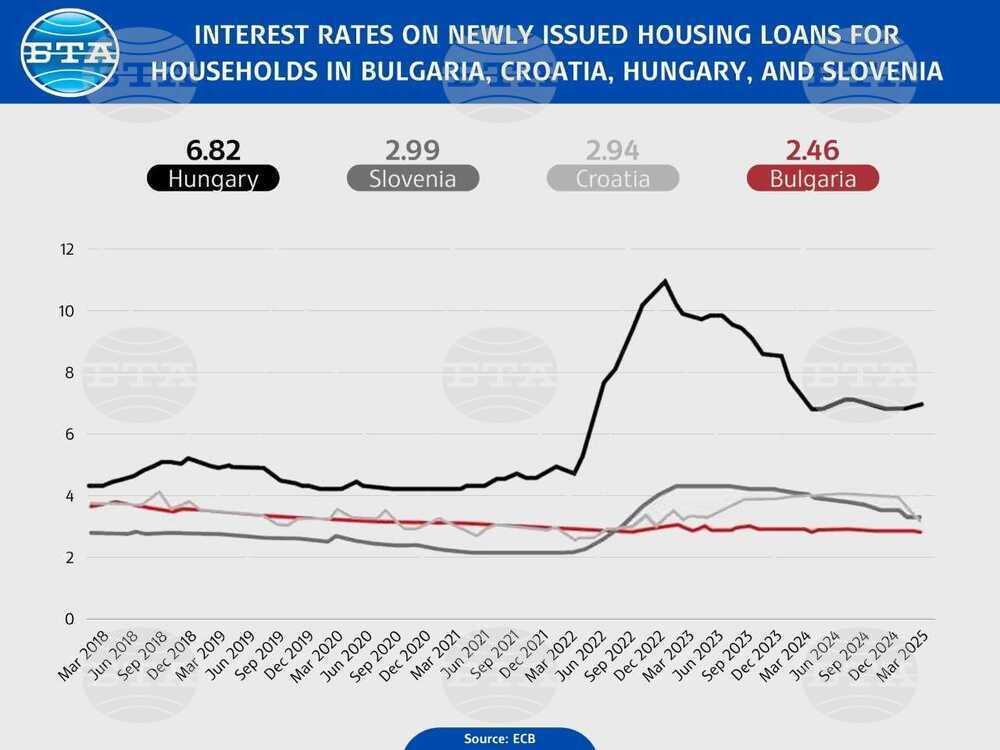

As of end-March 2025, the average interest rate in Bulgaria in national currency for newly issued home purchase loans was 2.46%, compared to 2.94% in Croatia, 2.99% in Slovenia, and 6.82% in Hungary, according to the analysis based on European Central Bank data.

The total amount of housing loans in Bulgaria issued in BGN with a repayment term of over five years stood at BGN 25.9 billion at the end of Q1 2025, according to BTA’s review of data from the Bulgarian National Bank. This represents nearly 96% of the total volume of all housing loans in the country, which slightly exceeds BGN 27 billion as of end-March 2025 (including regular, non-performing, and restructured loans). In comparison, housing loans with repayment terms over five years issued in foreign currency amounted to BGN 841 million by the end of the review period.

According to the analysis, subscription packages offered by banks in Bulgaria provide high accessibility to banking services. These packages offer up to 6.6 times lower cost compared to using individual services separately, including account opening and maintenance, debit cards, ATM withdrawals from the bank’s own network, internal transfers, and interbank paper-based transfers – up to a certain number of transactions. Notably, some banks offer packages targeted at youth and pensioners, which come with much more favourable conditions than those for the average customer, ABB highlights.

According to data on payment service providers' fees, published and publicly accessible on the central bank’s official website, the cheapest “basic” banking package among Bulgaria, Croatia, Hungary, and Slovenia is in Bulgaria at EUR 1.70/month, compared to EUR 5.90 in Croatia, EUR 4.90 in Hungary, and EUR 5.90 in Slovenia. In this case, the basic banking package in Bulgaria is 188% cheaper than Hungary’s equivalent and 247% cheaper than those in Croatia and Slovenia, the analysis notes.

At the same time, the price of a “standard” package in these countries is again lowest in Bulgaria, being 44.5% cheaper than in Hungary, 248.9% cheaper than in Slovenia, and 305.3% cheaper than in Croatia. These packages include an extended range of services, including account and debit card maintenance, mobile number transfers within the same bank, mobile banking, BGN and EUR transfers within the same bank via mobile banking, utility payments, cash deposits and ATM withdrawals from the bank’s own machines, among others.

Digital channels ensure high accessibility to banking services in Bulgaria, the analysis says. One of the most visible aspects of the digitalization of the banking sector is the sharp increase in cashless payments – especially via debit and credit cards, mobile apps, and online banking.

When analyzing banks’ fee and commission income, it is important to note that these include a wide variety of services, such as investment brokerage, consulting services, and others, ABB adds.

/RY/

news.modal.header

news.modal.text